Contents:

Notice that the bearish candles become bigger and bigger with the progress of the price decrease. The exponentiality here implies that a pullback might be coming. If you trade a bullish Harami pattern, your Stop Loss order should go below lowest point of the first Harami candlestick – the longer bearish candle. If you trade a bearish Harami pattern, you should place your Stop Loss above highest point of the first Harami candlestick – the longer bullish candle. In this example, we are using a downtrend to emphasise the bullish reversal pattern. A Harami Cross is a reversal candlestick pattern that consists of a long candle is followed by a Doji.

Hypothetical performance results have many inherent limitations, some of which are described below. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. It’s a reversal pattern because before the Bullish Harami appears we want to see the price going down, thus it’s also a frequent signal of the end of a trend. Technical analysts often use the Bullish Harami candlestick pattern as a signal to buy an asset.

AGIX Price Analysis: AGIX Price Exhibits An Illusion in the price – The Coin Republic

AGIX Price Analysis: AGIX Price Exhibits An Illusion in the price.

Posted: Mon, 27 Mar 2023 07:00:00 GMT [source]

When you see a bullish harami, you should be cautious about entering a long position because it may be an indication of a price reversal. If you do decide to enter a long position, then you should wait for confirmation from another indicator before placing your trade. In an engulfing pattern, the two candles should have opposite colors.

Bearish Harami Pattern

The bearish harami pattern appears at the top end of an uptrend, allowing the trader to initiate a short trade. As seen in the GBP/USD 30-min chart, the RSI crossover occurs exactly at the same time when the bullish harami appears and is above the 30 level. The MACD crossover, on the other hand, occurs even before the pattern occurs which provides a strong indication that the momentum of the bearish trend is over. Analysts looking for fast ways to analyze daily market performance data will rely on patterns in candlestick charts to expedite understanding and decision-making.

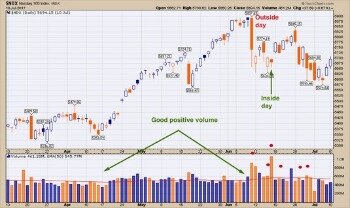

The trading action reconfirms bulls dominance in the market. Unlock our free video lessons and you will learn the exact chart patterns you need to know to find opportunities in the markets. Nonetheless, when you are able to find the boundaries of the previous trend, Fibonacci support and resistance levels can help you confirm the trend reversal and find the right entry level. Therefore, to identify the pattern, you need to find a two candle pattern at the bottom of a downward trend with the above features. In case of a bearish harami, you should place a sell-stop slightly below the bigger candlestick. Second, you should then look closely at the movement of the candlesticks and identify when a large candlestick is followed by a small candle.

The Trading Psychology Behind a Bullish Harami

In Westernized investment terminology, a Bullish Harami candlestick pattern is referred to as “an inside day”. All types of investments are risky and investors may suffer losses. Past performance of investment products does not guarantee future results. The responsiveness of the trading system may vary due to market conditions, system performance, and other factors. Account access and trade execution may be affected by factors such as market volatility.

- The idea is to initiate a short trade near the close of P2 .

- Investors looking to identify harami patterns must first look for daily market performance reported in candlestick charts.

- The next signal appeared after the last gap, a red candle with a long lower shadow created a resistance area.

- The Structured Query Language comprises several different data types that allow it to store different types of information…

- The tall black candle speaks of a continued downward price trend but the next day, a white candle appears.

The blue candle not only encourages the bulls to build long positions but also unnerves the bears. Get ready to receive three amazing chart pattern videos that are over 30 minutes long straight into your inbox. The body of the second candle should lie somewhere in the lower half of the first candle. The body of the second candle should lies somewhere in the lower half of the first candle. DTTW™ is proud to be the lead sponsor of TraderTV.LIVE™, the fastest-growing day trading channel on YouTube.

The Bullish Harami is a two bar candlestick pattern that develops after a down leg. After a sell-off in price, this pattern is formed when the real body of the second candlestick trades completely within the range of the real body of the previous candlestick. As with any trading analysis/technique, the harami cross technique comes with many advantages and disadvantages. Some benefits of the harami cross strategy include attractive entry levels for investments as the trends potentially reverse upwards. The movement is more straightforward to spot for beginner traders than many alternatives, providing a more attractive risk-reward ratio for many of its users.

The formation sets the tone for a potential reversal after a long downard move in the stock prices. As you can see, a harami candlestick pattern is made of two candle. A closer look shows that the two sticks have a close resemblance to a pregnant woman. As mentioned above, harami is the Japanese term for pregnant.

What Is A Bullish Harami?

Scroll through widgets of the different content available for the symbol. The “More bullish harami” widgets are also available from the Links column of the right side of the data table. Switch the View to “Weekly” to see symbols where the pattern will appear on a Weekly chart. As the structure of this pattern is so simple and frequent, you can spot harami quite often.

The higher the trading volume on the downtrend, the stronger the reversal signal that comes with the harami. The close of the bullish candle must be below the previous open of the bearish candle. The open of the bullish candle must be above the previous close of the bearish candle.

Structured Query Language is a programming language used to interact with a database…. There is a gap between both candles, and the gap contains no shadows. This second candle has a lower high and higher low than the first one.

Bullish Harami, Bearish Harami, and Advanced Candlestick Patterns

One of the most common candlestick setups in Forex trading is the Harami pattern. Candlestick patterns are an essential form of Forex technical analysis. Ten periods later, the Stochastic Oscillator enters the overbought zone, giving us a signal that this bullish impulse might be exhausted.

Bullish Harami: Definition in Trading and Other Patterns – Investopedia

Bullish Harami: Definition in Trading and Other Patterns.

Posted: Sun, 26 Mar 2017 00:36:12 GMT [source]

https://trading-market.org/s that the trend is moving from a downward trend to a neutral or upward trend. The small white candle should be at least 50% or more than half the size of the preceding red candle. However, they are not the same, and engulfing patterns are more potent. Even though there was not any prominent news or event , there were enough bullish signals. As you see, the market retraced up almost 100% of the previous down move. You cannot short in the cash market for extended period – to short and carry positions you need Futures.

It can be used by investors to identify price patterns. Listed below are the requirements for a Bullish Harami candlestick pattern. For further information about Moomoo Financial Inc., please visit Financial Industry Regulatory Authority ’s BrokerCheck.

Candlestick patterns for stock price analysis emerged in Japan, and the word ‘Harami’ in Japanses language means ‘pregnant’. A look at this bullish harami pattern formed by the two candles represents a woman carrying a baby, hence the name. The first red-colored long bearish candle is often called the ‘mother candle’, while the second green-colored bullish short candle is often called the ‘baby candle’.

In case of a bullish harami, you could place a buy-stop above the upper shadow of the mother candlestick. Here, the bullish trade will be initiated if the price moves above the shadow. While a Bullish Harami candlestick pattern may not be the best trend reversal identifier, it can and usually does signal a bottoming process that has started or is about to start. While a Bullish Harami candlestick pattern may not be the best trend reversal identifier, it can and usually does signal the a bottoming process. Either way, just like with any other market indicator, it’s better not to use the harami pattern alone.

The other more obvious signal comes when the price actually breaks the blue trend line in bearish direction. Unfortunately, this closing candle is a bit long and is very likely to eat a big part of your already gained profit. So, with the case of bullish Harami candlestick pattern, the Stop Loss order should lay below the lower candlewick of the first candle, which in this case is bearish. If the third candle is in the direction of the Harami pattern and closes beyond the level of the second candle, you are good to go and you can enter the market in the respective direction. This sketch briefly explains the structure of the two Harami reversal patterns. We added the arrows to outline the previous price direction and the expected outcome.

- The MACD and RSI are two of the most important momentum indicators that you can use when identifying the bullish harami pattern.

- Long story short, no matter where these are found – they still indicate a potential bullish movement will happen shortly after.

- Validate the discovered bullish harami with other technical tools and patterns.

- Candlestick chart analysis are one of the most popular types of technical analysis because they allow traders to evaluate price data using only a few price bars quickly.

In most cases, when the pattern appears in its perfect formation, the price usually reverses and the pattern is accurate and reliable. Having said that, the pattern should not be traded on its own. Instead, it’s best to add other technical indicators to confirm the reversal and find entry levels, stop loss and take profit orders. The bullish harami candlestick pattern is a reversal pattern that can be seen in the aftermath of a downtrend. This may prompt some traders or investors who are looking at this pattern as confirmation for entering long positions on an asset’s price to make their move now rather than later.

In an uptrend, it means that buyers have failed to follow up on the surge of activity and close the second candlestick at or near the high of the previous candlestick. Bullish harami candles that appear within a third of the yearly low perform best — page 385. My book,Encyclopedia of Candlestick Charts, pictured on the left, takes an in-depth look at candlesticks, including performance statistics. If traders receive enough confirmation, they will most likely buy the security with the hopes the new upward trend continues and their investment grows. The hamari cross pattern consists of one candlestick and one doji fully contained by the previous candlestick.

When the second candlestick is a Doji, the pattern is called a Harami Cross. Determine significant support and resistance levels with the help of pivot points. Learn how to trade forex in a fun and easy-to-understand format. Signals that the trend is moving from an upward trend to a neutral or downward trend.

The color of this first candle can be either black or white, but it must be long. However, along with prior trend and other checklist variable, the probability of a reversal increases. The close price of P2 should be greater than the open price of P1. The unexpected negative drift in the market causes panic making the bulls to unwind their positions. On P2 the market unexpectedly opens lower, displaces the bulls, and sets in a bit of panic to bulls.

The more complex problem is to find the best interpretation of this pattern. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success. If you are day trading, the Daily Pivot Points are the most popular, although the Weekly and Monthly are frequently used too. Here are a few strategies to trade the Bullish Harami pattern. The most common is to use the other side of the pattern to set it. A Bullish Harami appearing after this bearish move is a sign of a possible reversal to the upside.

Technical View Bullish Harami pattern on weekly scale raises possibility of upward journey in Nifty – Moneycontrol

Technical View Bullish Harami pattern on weekly scale raises possibility of upward journey in Nifty.

Posted: Fri, 30 Dec 2022 08:00:00 GMT [source]

If there is no movement between the first and second candlestick, this pattern is not valid and should not be traded. In a harami pattern, the first candle is taller than the second one. Conversely, in an engulfing pattern, the second candle is larger than the first one. It did not appear at the end of a downtrend or the end of a major correction pattern. In early October, Goldman Sachs made a bullish harami that was not the start of a new trend. This pattern clearly reminds us to look for singnals when a pattern appears.

For the pattern to be a valid Harami Cross, the Doji should be located within the body of the… There are two types of Harami candlestick patterns – the Bearish Harami pattern and the Bullish Harami pattern. Generally, there are three differences between a bullish harami and a bullish engulfing pattern. The red candle of the harami with its preceding candle made a bearish engulfing pattern, which is more potent.