Content

Escrow broadly refers to a third party that holds money or an asset on behalf of the other two parties in a transaction. Despite its mysterious connotations, “suspense” in this case simply refers to the fact that a transaction or its designation in a company’s books has been suspended temporarily, pending some further action. Or if you are paying more than you need to, you may be losing money that you could hold onto or use to pay down your principal faster. You now owe payments of $2,000 for March and April plus the $100 late fee. If all goes well with your mortgage, your money will always go toward paying your balance, and you’ll never accidentally underpay or overpay your mortgage balance. Get up and running with free payroll setup, and enjoy free expert support. To update your email, go toCustomer serviceat the top of the page, selectMy alerts, and then selectAccount alerts.

Pre-funding company contributions throughout the year even though they won’t be allocated to participant accounts after the end of the year. In accounting, the controlling account is an account in the general ledger for which a corresponding subsidiary ledger has been created. Sometimes, you don’t have all the necessary information for accounting. Missing or incorrect details can derail your bookkeeping efforts, suspense balance but you need to record every transaction. Use a suspense account when you’re not sure where to record general ledger entries.

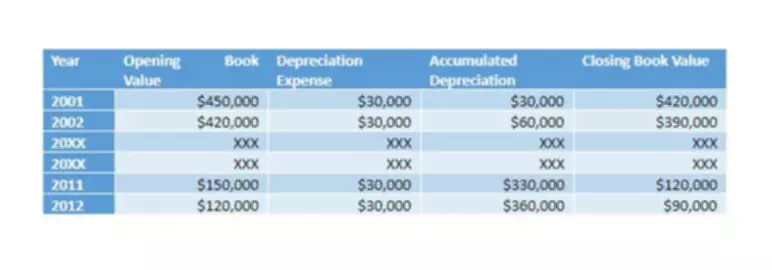

Example #4 – Trial Balance

Most homeowners can probably catch up on their payments, but it is a preventable type of mortgage deficiency. Regardless of the issues in question, suspense accounts are cleared out once the problem is addressed, at which time the funds are promptly re-shuffled to their correctly designated accounts. At that point, the suspense account should achieve a balance of zero dollars. While there is no definitive timetable for conducting a clearing-out https://quickbooks-payroll.org/ process, many businesses try to regularly accomplish this on a monthly or quarterly basis. However, if the borrower continued to pay only $850 instead of the new monthly payment of $975 then a suspense account would be set up and rolling late payments would follow shortly thereafter. Once you’ve cleared your suspense account, make sure that you – and your autopay – are set to pay the correct amount each month to cover your monthly balance.

Likewise, if the trial balance shows debits are larger than credits, the difference should be entered as a credit because the amount will be cleared once the difference has been reconciled. Once the accountant has enough information, mortgage suspense account they can reassign the transaction out of the suspense account and into the appropriate account within the general ledger. Stay up to date on the latest corporate and high-level product developments at BlackLine.

Statement doesn’t come from owner of note

Each individual’s unique needs should be considered when deciding on chosen products. Just like the mortgage suspense account, investors keep their money in this account until such time that they are ready to purchase new investments.

- When a fee has been applied to your home loan, we may apply a portion of your payment to an outstanding fee.

- Sometimes, you don’t have all the necessary information for accounting.

- But thanks to relatively new bankruptcy rules, the borrower was getting monthly statements during the bankruptcy that showed the suspense balance.

- Once the corresponding invoice has been identified and the details about the transaction are known.

- We have alleged a violation of the federal Fair Debt Collection Practices Act and the North Carolina Collection Agency Act.

- So, let’s see how the creation of a suspense account will help you to solve your problem.

- We generally credit any payments made at the branch the same day.

Suspense accounts are used when your trial balance is out of balance or when you have an unidentified transaction. A lack of segregated duties and oversight through continuous, automated monitoring of journal entries is imperative and will ultimately prevent disaster. Across campus, departments use clearing, default and suspense accounts for a variety of reasons (Procurement Cards, Preferred Booking Program Travel, Credit Card Sales, etc.). But, the debtor account was wrongly credited with N9000, instead of 10,000. To correct this error, we debit the suspense account with N10,000 and credit the debtor’s account with the same amount.

Investing Suspense Accounts

Increase accuracy and efficiency across your account reconciliation process and produce timely and accurate financial statements. Drive accuracy in the financial close by providing a streamlined method to substantiate your balance sheet. If you have an escrow account, a portion of your contractual payment due will be applied to your escrow account. In addition, if you pay over your contractual payment due and your escrow account has a negative balance, we may apply a portion of your payment to your escrow account. The way you’ve handled your finances in the past can help predict how you may do so in the future, so lenders will consider your credit rating when you apply for a mortgage or other loan. A higher credit score may help you qualify for a better mortgage interest rate, and some lenders may lower their down payment requirement for a new home loan if you have a high credit score. Companies decide how often they want to review the entries recorded under suspense accounts.